Are you thinking about moving to Canada? Do you live here already but want to reach financial success? Whether you are a newcomer or a citizen of Canada, you may probably want to know the tips and tricks on how to build wealth.

It can be challenging and expensive to start a life in a new place. You don’t need to accept the first job offer that might be beneath your level of expertise in order to do it for a living. Keep on reading to find out the top-rated tips on how to become financially successful.

Know Your Aims

The very first tip from people who have already reached success in Canada is about goal setting. You need to understand what you are willing to achieve in the long run. Think about the lifestyle you would like to have and what you should do to get it. Having a certain plan and a vision will help you move towards this goal and make savvy decisions. When you set goals and clearly see your targets, you will be able to make small steps in this direction.

Create a Budget

The next step is to set a short-term and long-term budget. Having a budget means you know exactly where your income goes and whether you are good enough with monthly spending. It will help you define how much savings you are having and how much you should earn to reach your goals.

Knowing exactly what is missing and what should be changed is beneficial. You may utilize a budget calculator for this purpose and find it on the web. Besides, a monthly budget will protect you from financial emergencies. While Ontario payday loans may be helpful in times of crisis, having a fund for the rainy day will assist you with unforeseen expenses without the need to take out lending options.

Build Your Credit History in Canada

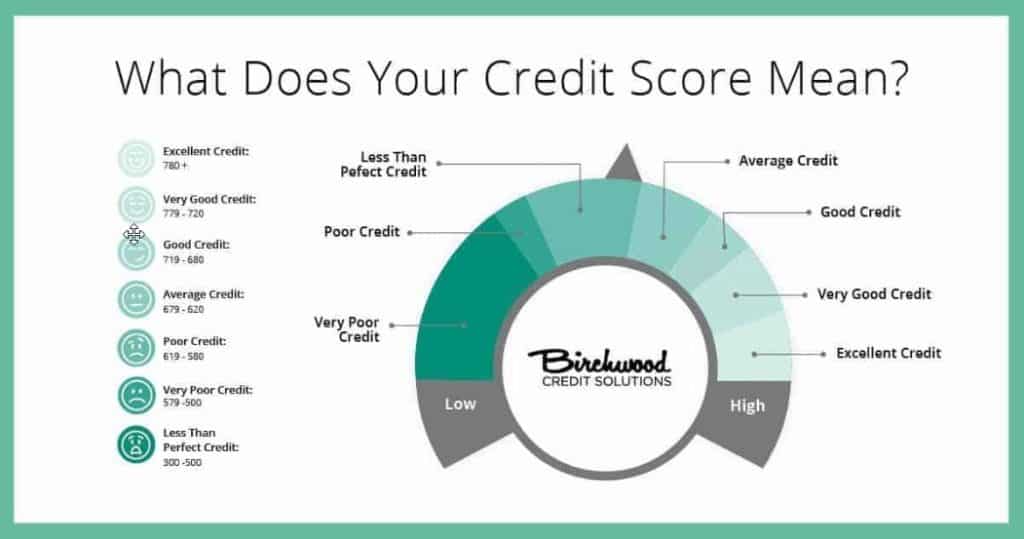

If you are planning to come to live in Canada, you also need to establish a credit history here. It is not just an important factor that determines your creditworthiness but also allows you to rent an apartment, secure a loan, lease an auto, or buy a new cell phone.

Having a good credit history is essential if you decide to get a mortgage later and even land a well-paid job.

You may think you don’t need to take out a loan now but life can change all of a sudden. In order to qualify for the lowest interest rates you should follow these practices on how to build your credit:

- Pay all the bills on time and make regular payments to prevent higher costs and fees.

- Apply for a credit card to secure lending products. This tactic will showcase your ability to be a responsible borrower and customer. In order to build credit faster, you may take out a small loan and repay it according to the repayment terms.

- Keep your account balances below 35% if possible. Credit reporting bureaus will see your account balance and boost your credit rating.

Try to Earn More

It may be difficult to find a decent job straight away especially if you’ve just moved to Canada. You need to have credentials, local experience, and even a good credit rating in order to land the job of your dreams. Many consumers try to remain financially afloat while they have an urgent need to pay monthly bills and wish to have secure employment. To help you find a job faster, try the following:

- Search for “help wanted” or “now hiring” signs.

- Tell other people about your plan to land a job. Networking can be extremely useful for this purpose.

- Utilize local websites such as Workopolis and SimplyHired.

- Use labor platforms like Fiverr, Uber, Ask for Task, or Kleiner.

Climb the Career Ladder

Once you have some employment, it’s time to think about building your career in this country. You may have been a certified specialist with great experience in your home country but accept any job opportunity right away. When you feel more settled you can start job searching and find similar positions according to your certifications.

Salary platforms like Payscale and Glassdoor will help you network with other professionals in your field and also learn about your current income. There are several programs to help people transition into some fields and secure internships. You may choose between Ontario Bridge Training Programs, Federal Internship for Newcomers Program, Career Edge, or Access Employment Bridging Programs.

Learn About the Local Culture

If you want to become successful in Canada, you should also embrace its culture and know how everything works there. Networking and negotiations may help you learn more about the opportunities connected with life, work, and other aspects. You may want to attend some local events or celebrations, get to know Canadian people, read local blogs, and set up some interviews.

Once you understand how things work in this country and embrace its culture, it will be easier for you to assimilate and feel secure. Don’t feel embarrassed to talk to people and ask for help. If you can afford to pay a financial advisor, you may obtain even more pieces of advice on how to handle personal finances and avoid debt. If not, local people and web platforms can assist you in this process for free.

The Bottom Line

It may take some time and certainly effort to reach financial success. This road may be challenging and bumpy but it’s definitely worth giving a try. You surely want to lower the risks and increase your chances of success.

Having financial stability is what every person dreams about in any country. When you move to another place and start a new life from scratch, it can be time-consuming to adapt to new circumstances. If you follow these tips and pieces of advice from people who have moved to Canada and already become successful, you will avoid pitfalls and save your time.

You may also like

-

How to Find the Best Deals in Alberta

-

Finding the Right Debt Relief Solution to Save Money and Avoid Bankruptcy

-

Navigating the Crypto World: Tips for Successful Investment Ventures

-

The Bitcoin Breakthrough: Unveiling the Future of Financial Investment

-

Dogecoin Discovery: Exploring the Untapped Potential of Crypto